- WIF, one of the best performing memecoins this cycle, lost some of its value and dropped out of the top 50.

- Data from showed that millions of short positions would face liquidation if the WIF bounced.

dogwifihat [WIF]Solana [SOL]-The underlying token that kept other memecoins on track is now in a place that no one would have imagined a few months ago. In the last 30 days, the price of WIF crypto has decreased by 45.83%.

Not only that, the cryptocurrency has also dropped out of the top 50 by market cap. At press time, WIF was trading at $1.53. Its market cap was $1.56 billion, with Fantom [FTM] taking her place.

Although dogwif was launched in mid-December 2023, its rise to stardom was in the first quarter of 2024. During that time, the price jumped by more than 1500%.

WIF volume is no longer on top

This helped the WIF crypto price reach an all-time high of $4.84. While there were predictions that WIF would rise to $10, none of that has happened since this steep correction began.

At one point, some analysts mentioned that memecoin will flip like Pepe [PEPE] and the Shiba Inu [SHIB]. But this did not happen.

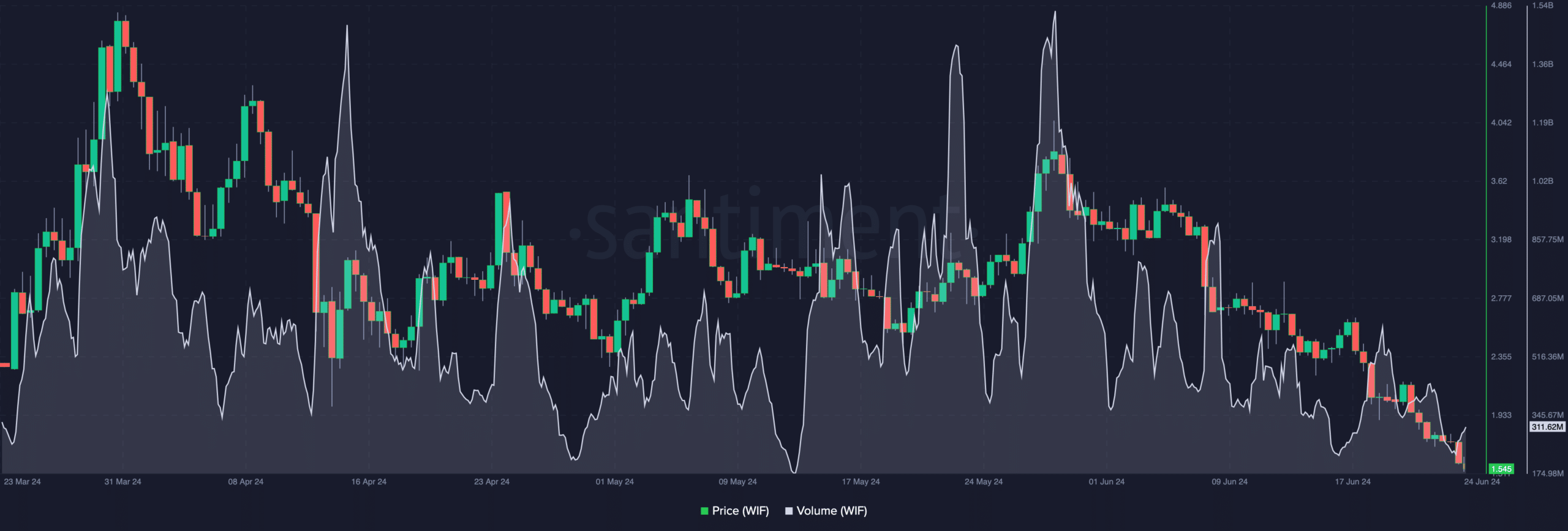

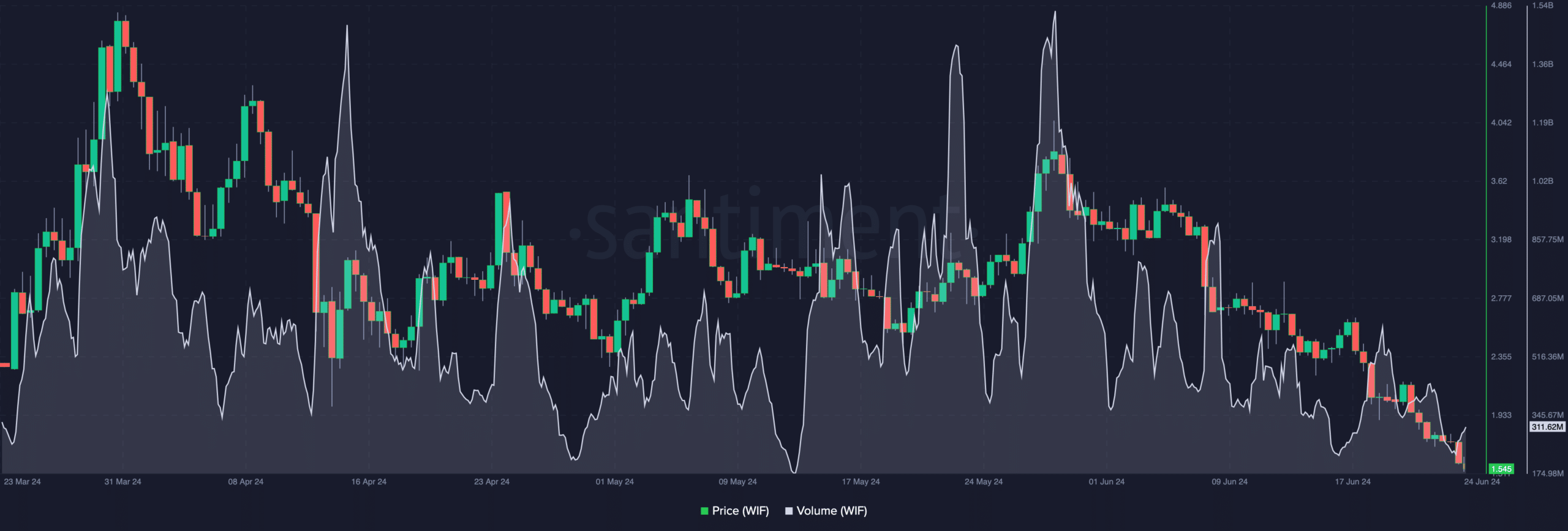

For this piece, AMBCrypto examined Dogwifhat’s on-chain status and its potential for the future. The first metric we looked at was WIF’s crypto volume.

According to data from Santiment, the token volume was $211.62 million. This was close to the lowest level it has reached since May 13.

When WIF experienced its quarterly growth, the volume reached close to $2 billion in some cases.

Source: Sentiment

It bears the risk of liquidation

Therefore, the value at press time implies that interest in the land was near an all-time low. As such, it may be challenging for the price to recover some of its losses.

However, if market participants in their numbers take advantage of the discount offered, the WIF price may be reinstated. But not many traders are confident in the return of WIF.

For example, blockgreze, a pseudonymous marketer, posted on X (formerly Twitter). According to him, he does not believe that memecoin has provided another buying opportunity. He wrote that,

“A lot of people are talking about how WIF is in their accumulation zone, but I just checked the chart and it doesn’t look like anyone is accumulating.”

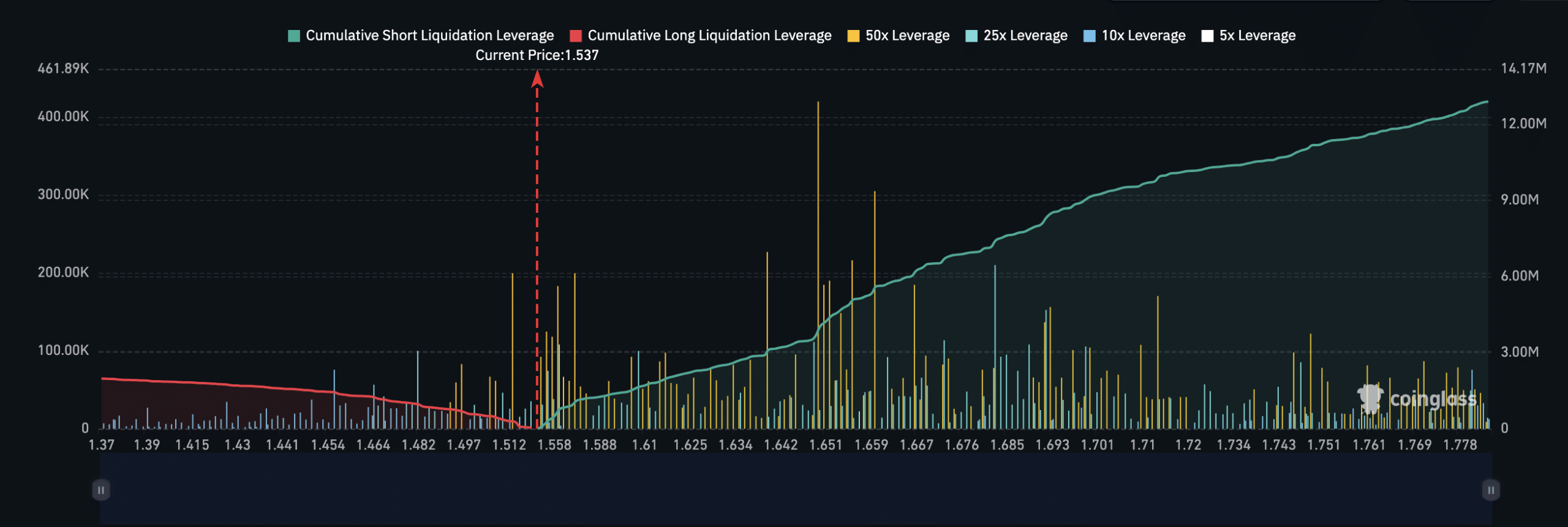

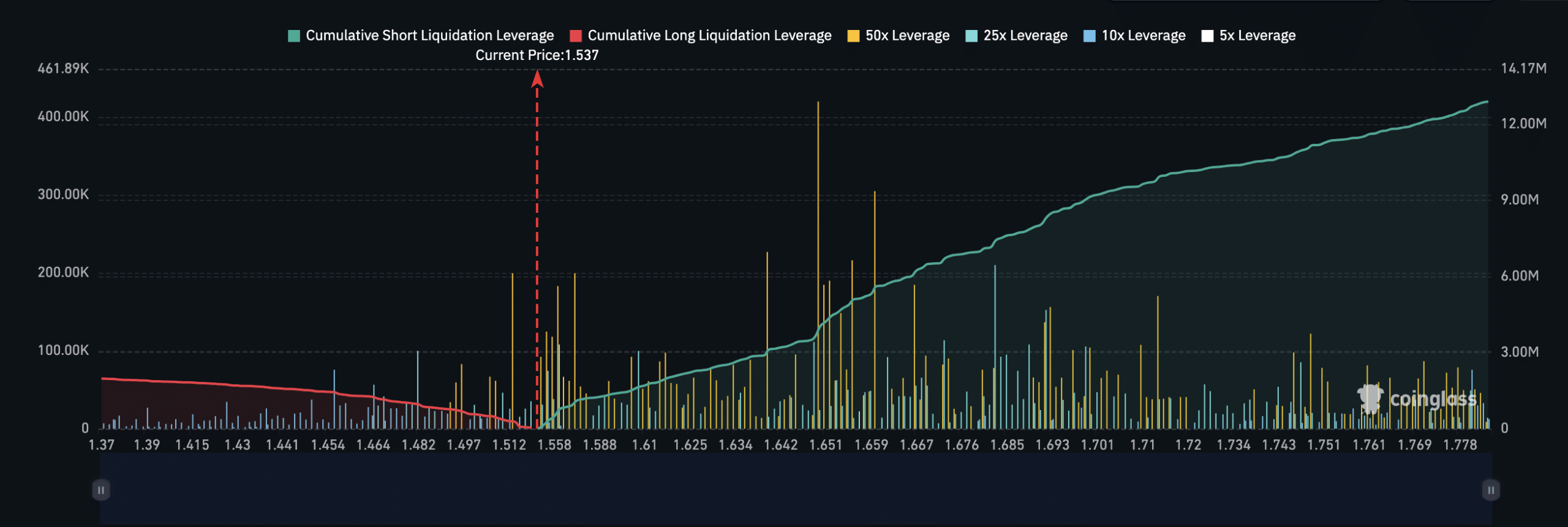

Additionally, traders risk losing millions if the price of WIF rises, according to Coinglass data. AMBCrypto noticed this after looking at the liquidation map.

Liquidation occurs when an exchange forcibly closes an open position to reduce the risk of further losses.

This is usually due to insufficient margin balance or high volatility when the market is moving in the opposite direction of a trader’s position.

For the liquidation map, it identifies the prices where traders are exposed to liquidation risks. At press time, we noted that a total of 12.89 million short positions could be liquidated if WIF returns to $1.78.

Source: Coinglass

However, if the WIF crypto price falls to $1.37, just under 2 million long liquidations will occur. In the broader view, the perception about WIF was in a discouraging position.

Is it over for WIF?

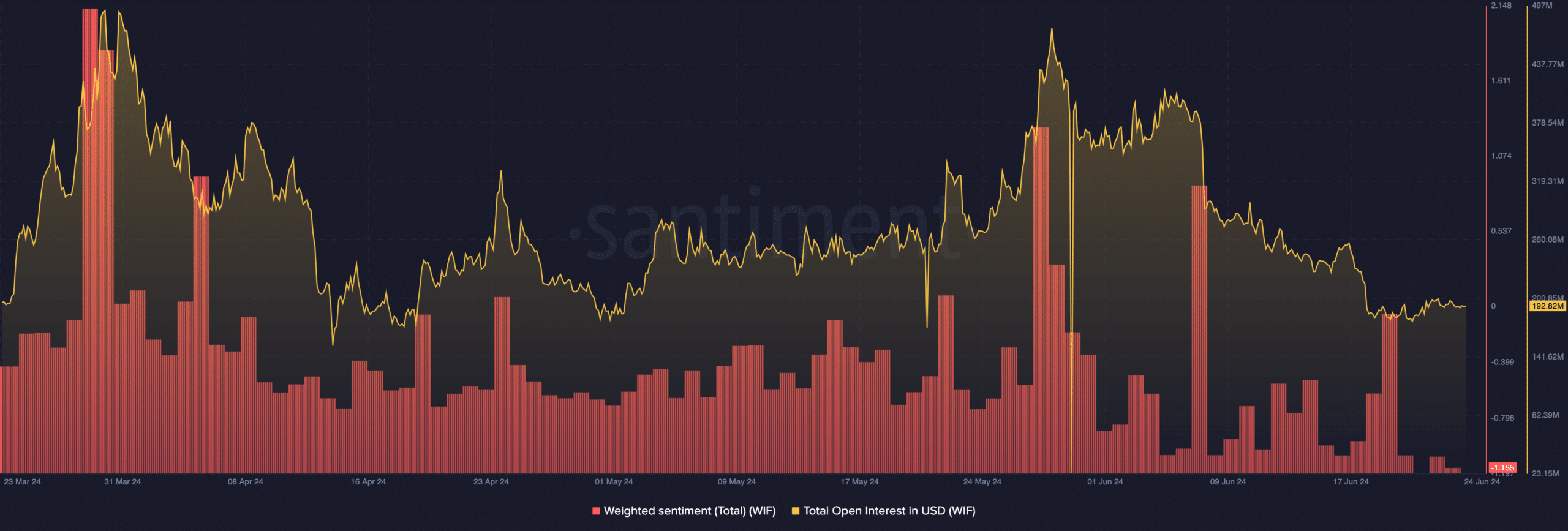

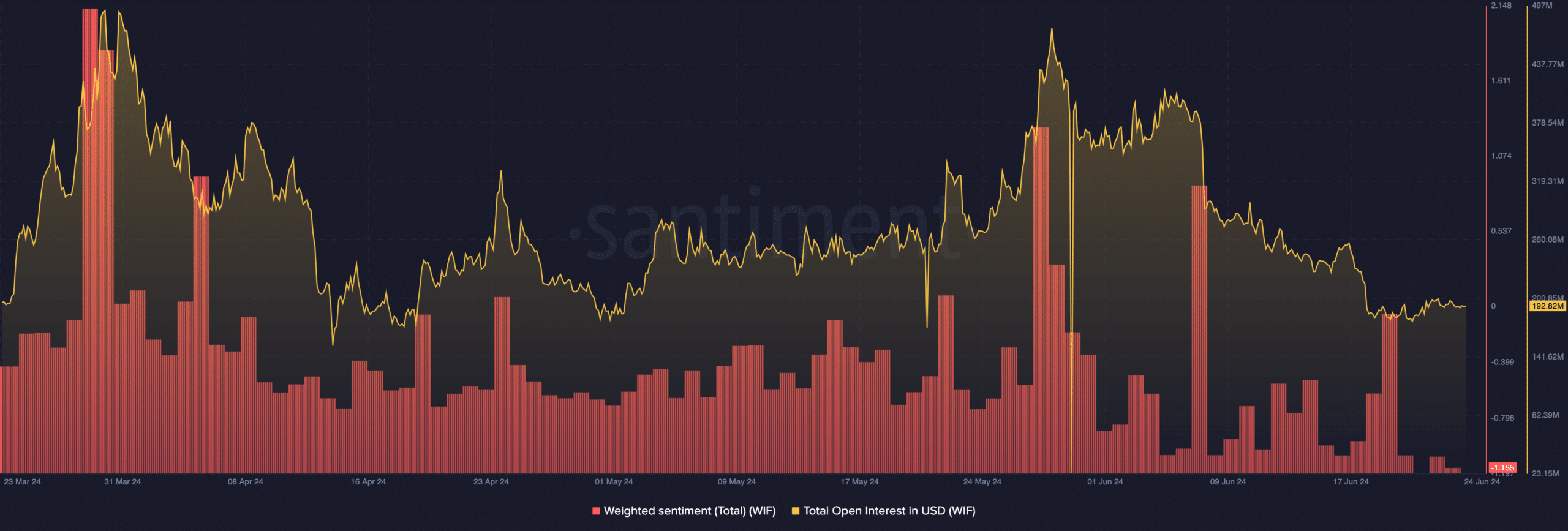

At press time, WIF’s weighted sentiment, based on on-chain data, was -1.15. This was the lowest level WIF had reached in the last six months.

The weighted sentiment shows the comments made online about a project. Therefore, the decline meant that for every positive memecoin comment, there were 1.15 more headed towards the bearish outlook.

If this continues, the price of WIF may continue to fall. If that happens, the price could drop to $1.35.

At the same time, extreme negative feeling sometimes acts as fuel for healing. If this happens in the case of WIF, the value of the token could go in the direction of $2.

Source: Sentiment

Meanwhile, Open Interest (OI) in WIF has fallen below the $200 million mark. OI is the amount of futures contracts outstanding in the market.

Realistic or not, here is WIF’s market level in PEPE terms

When it increases, it means that the net position is moving up. However, a decline, as in the WIF situation, implies that traders are closing existing positions.

If this position holds, then the price of WIF may decrease and the market cap may slip below the 51 position.

Leave a Reply